Calculating cost of borrowing

The charge will stay on the bill unless you go through the process to waive the insurance. Borrowing expenses such as loan application fees and mortgage discharge fees.

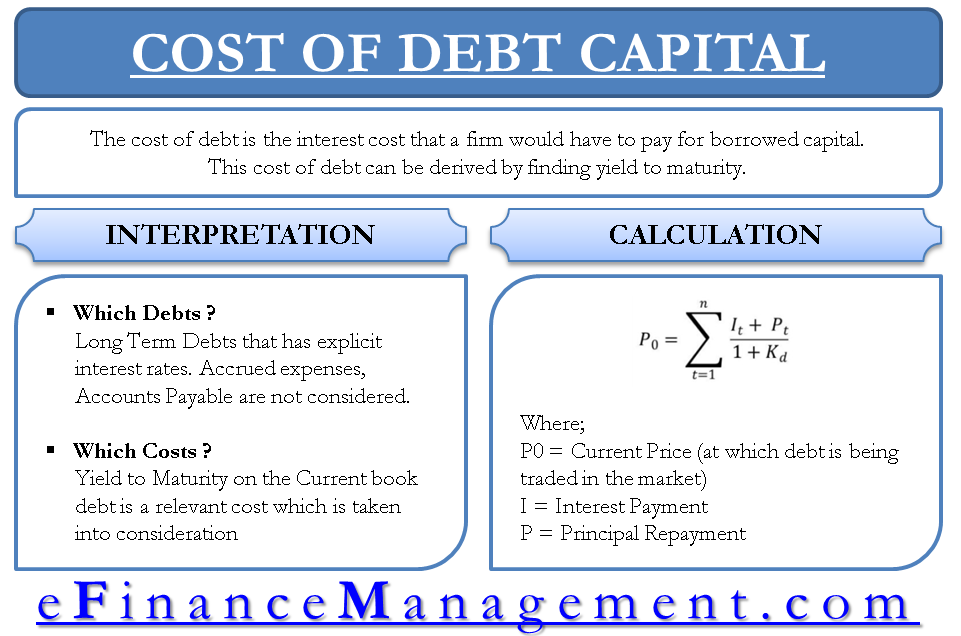

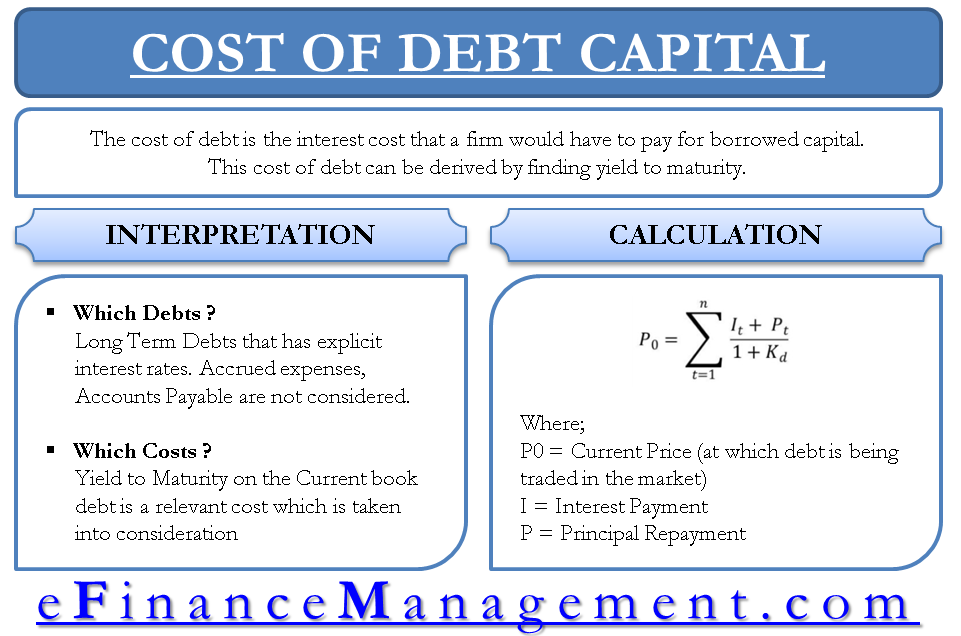

Cost Of Debt Capital For Evaluating New Projects Yield To Maturity In 2022 Accounting Basics Accounting Books Accounting And Finance

Victorian public libraries offer more than just borrowing books.

. Your income expenses and deposit are the biggest factors determining your borrowing power but lenders also consider other factors such as your existing debts and if you are using a guarantor for the loan. The interest expense also known as the cost of borrowing money can be classified into the following two types. Short Sale Proceeds interest paid to you by IBKR.

There are two factors for daily costrevenues associated with short selling of stocks and bonds at IBKR. Today the market value of your mutual fund shares is. This is the wrong approach because WACC includes an equity component and is not specific to the leased asset.

By definition the interest rate is simply the cost of borrowing the principal loan amount. How much can I borrow. 5 x 1000 x 4.

Change Date March 24 2011 41551 5B1a Closing Cost and Minimum Cash Investment Requirements Under most FHA programs the borrower is required to make a minimum downpayment into the transaction of at least 35 of the lesser of the. There are special words used when borrowing money as shown here. It is a good idea to come to court ready with calculations based on.

Find out what it may cost you to pay all or part of your closed mortgage before the maturity date. What information to give to your treasury department. For example a food products company needs to lease a large pasteurizing machine.

Assumes that positive cash flows are reinvested at the firms cost of capital and. Calculating the Internal Rate of Return with Excel. Cost of Borrowing.

Alex is the Borrower the Bank is the Lender. Say you have 1000 shares of a mutual fund and your lowest-cost shares were purchased for 10 your highest-cost shares were purchased for 100 and your average cost per share is 50. If youre borrowing money you want to make sure the growth opportunity will generate enough revenue to justify the cost of the loan.

We will call you to walk you through the terms and conditions. Calculating interest at court. On the other hand APR is a broader measure of the cost of a loan which rolls in other costs such as broker fees discount points closing costs and administrative fees.

Cost of a conveyancing kit or a similar cost. Closing cost and minimum cash investment requirements and types of acceptable sources of borrower funds. And so this is the normal way of calculating.

If the total cost of the lease is 1000 and the company. Dont forget your calculator. Our borrowing power calculator asks you to enter details including your loan term and interest rate income and expenses and any outstanding debts.

Calculate your loan Find out in just two minutes how much you can borrow and what your monthly repayments will be. Beta in the CAPM seeks to quantify a companys expected sensitivity to market changes. Calculating the incremental borrowing rate.

The final calculation in the cost of equity is beta. The density of sunlight per unit land area in Cambridge latitude 52 is about 60 of that at the equator. Hence the investors use the following formula to calculate financing costs.

Cost of debt refers to the effective rate a company pays on its current debt. Usually interest rates for finance costs are not published by the Companies. Calculating ROI can also come in handy if youre trying to determine which investment makes the most sense for your bottom line.

Otherwise you could find yourself drowning in debt. While calculating finance costs is one method to analyze the. Sunlight hitting the earth at midday on a spring or autumn day.

Calculating Implicit Interest Using a Spreadsheet Download Article. In most cases this phrase refers to after-tax cost of debt but it also refers to a companys cost of debt before. All councils raise money through rates to cover part of the cost of.

Work out the cost base of an asset including foreign currency and excluded amounts and when not to use the cost base. Borrowing from your home equity could help you make a major purchase renovate or consolidate debt. You can do research attend a seminar hear your favourite author speak and bring your kids to story time.

The cost of equity and cost of debt is required to determine for calculating the WACC which is difficult to estimate for private companies due to lack of publicly available information. For example if the simple interest rate is 5 on a loan of 1000 for a duration of 4 years the total simple interest will come out to be. It is the only company-specific variable in the CAPM.

The formula for calculating simple interest is. In other words instead of upfront payments these additional costs are added onto. Property values are used as the basis for calculating how much each property owner pays in rates.

So to borrow the 1000 for 1 year will cost. Because the profitability should exceed the cost of borrowing the fund. Usually borrowing costs are calculated using the Annual Percentage rate APR.

The Student Health Benefit Plan required by Massachusetts state law is not included in the overall cost but a charge of 3098 2022-23 rate will be automatically added to your tuition bill. 8 per annum if you are acting for a claimant. An Easy to Borrow or General Collateral Stock.

In this case the Interest is 100 and the Interest Rate is 10 but people often say 10 Interest without saying Rate. For depreciating assets there are special rules for calculating capital gains the cost. Sign the quote If you are already an ABN AMRO customer we will send you a.

For example a company with a beta of 1 would expect to see future returns in line with the overall stock market. The base rates for the last 10 years and the special account rates since 1st January 1980 are set out in note 7017 of the 2009 White Book. Calculate your available home equity and how much you could borrow based on this amount.

Short Sale Cost Calculating the Cost of Borrowing Stock at Interactive Brokers. Calculation of Financing Cost with Examples. They decide to lease rather than purchase it.

For public companies there are various methods for calculating the cost of equity. Finance firms making the loan are required to calculate the cost of borrowing for you. When a company uses different borrowing rates of.

Request a no-obligations quote We will send you a quote with no strings attached you have 30 days to consider our offer. A common mistake when calculating discount rates is using your weighted average cost of capital WACC to determine your discount rate.

Pin By Sh Investments On Random Mortgage Real Estate Information Mortgage Payment

Here S A Quick Guide To Knowing The Magic Of Compound Interest In 2022 Compound Interest Simple Interest Loan Calculator

Free Cash Flow To Equity Fcfe Formula And Excel Calculator

Cost Of Debt Should Be Interest Cost On Capital Yield To Maturity Efm

Nearly 70 Of Americans Say Borrowing Money Improved Their Finances Here S How To Avoid Financial Pitfalls Forbes Advisor

Excel Formula Calculate Payment For A Loan Exceljet

Understand The Total Cost Of Borrowing Wells Fargo

Cost Costing Cost Accounting And Cost Accountancy Cost Accounting Accounting Accounting Notes

Pin On Business News

Self Employment Income Statement Template Unique Example Format In E Statement Template Free Down Statement Template Profit And Loss Statement Income Statement

Advantages And Disadvantages Of Profitability Index Small Business Accounting Financial Life Hacks Learn Accounting

Difference Between Lease And Finance Economics Lessons Accounting And Finance Accounting Basics

Interest Rate Vs Annual Percentage Rate Top 5 Differences Interest Rates Percentage Rate

Degree Of Total Leverage Meaning Calculation Importance And More Financial Ratio Learn Accounting Financial Management

Borrowing Base What It Is How To Calculate It

Efinancemanagement Financial Life Hacks Finance Accounting And Finance

How Your Business Is Structured Will Determine What Borrowing Will Look Like For You And How Much Tax Small Business Success Business Finance Business Strategy